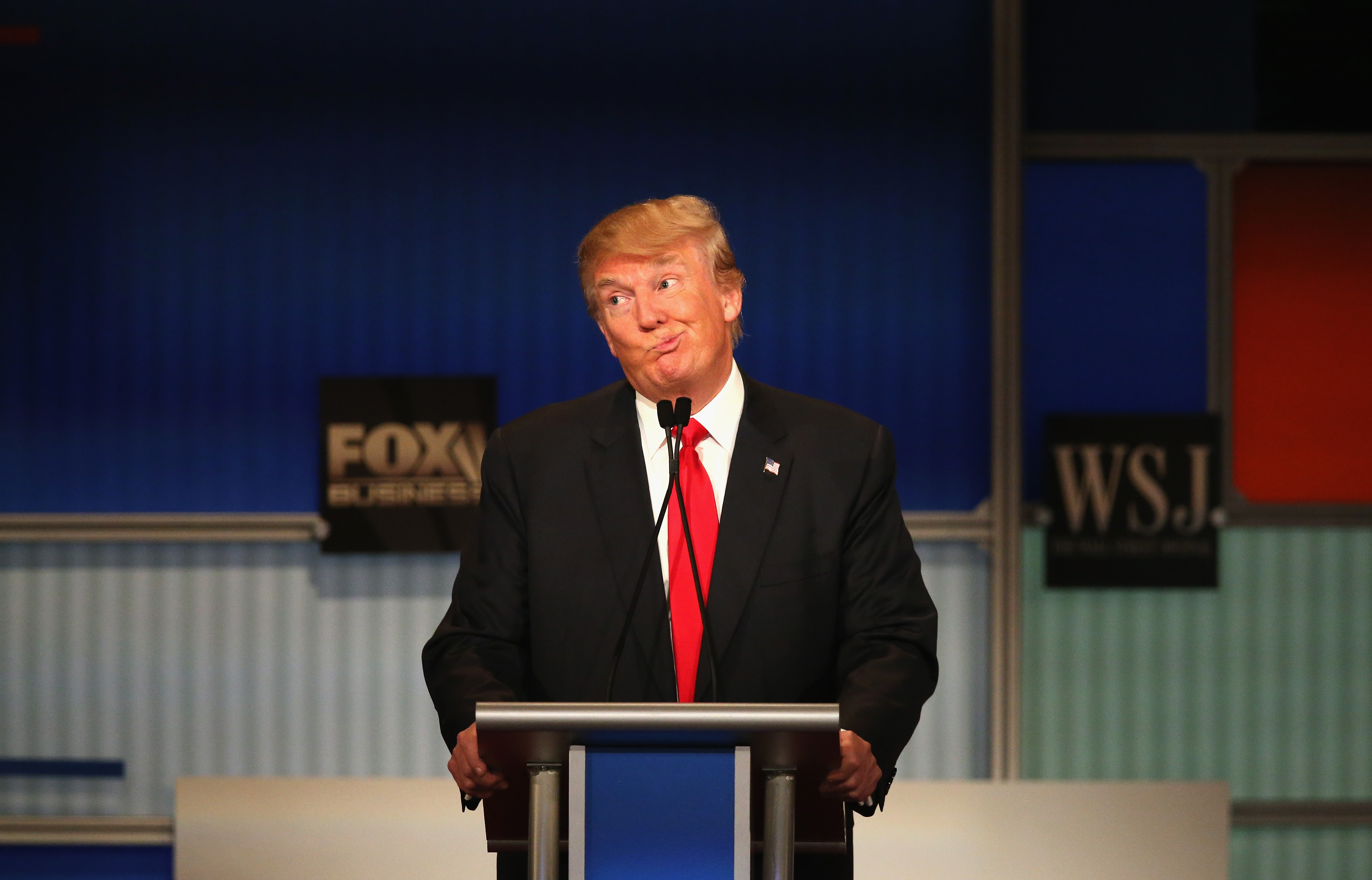

In the halcyon days of late 2016, one of the biggest and most pressing issues surrounding the election of Donald Trump involved the myriad conflicts of interest that would arise when he assumed control of the executive branch. Trump added to those concerns when he announced that instead of divesting from his business holdings, as many were calling for him to do, he would transfer control of empire to a trust managed by his adult sons, Eric and Donald Jr.

Is this working out as promised? That’s debatable, and we’ll hash through it below, but here’s exactly what Trump’s previous announcement meant, according to U.S. News & World Report:

“According to Trump, his sons, Donald Jr. and Eric, as well as a business associate, would be the trustees. After transferring the assets to the trust, Trump could then be a beneficiary of the trust,” says David Reiss, professor of law at Brooklyn Law School. “The trustees administer the affairs of the trust on behalf of the beneficiaries. The beneficiary receives the income from the trust or the property within the trust.”

Trump has previously said his children will be the primary financial beneficiaries of the trust, but Trump made it clear that he planned on returning to the Trump Organization when his presidency is over. At that point, it’s possible Trump could have a fat check waiting for him, depending on the trust’s structure.

However, according to Pro Publica, Trump’s even more involved with the trust than previously thought. According to letters from the Trump Organization addressed to the government, Trump can withdraw money from any of his 400 businesses, at any time, without disclosing it.

Per Pro Publica:

The previously unreported changes to a trust document, signed on Feb. 10, stipulates that it “shall distribute net income or principal to Donald J. Trump at his request” or whenever his son and longtime attorney “deem appropriate.” That can include everything from profits to the underlying assets, such as the businesses themselves.

Last week, in partnership with The Times and the Associated Press, Pro Publica released financial disclosure documents from White House staffers, but it is unknown if these trust revisions were contained in that document dump.

Trump is under no legal obligation to disclose when or how much he withdraws from the trust. He would have to list any profits as income on a tax return, but that’s a whole other thing. According to Steven Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center, who spoke with Pro Publica, “For tax purposes, it’s as if the trust doesn’t exist at all. It’s just an entity on paper, nothing more.”

Read the whole report over at Pro Publica.

(Via Pro Publica & U.S. News & World Report)