Here’s the thing about the 0.01% that you need to understand: They’re spectacular, as a group, at getting richer. Like world class. You know how Steph Curry is fire beyond the arc? Or how Beyonce owned Coachella? Or how Scorsese is unbeatable at filming gritty mob shit? None of them are nearly as skilled at their respective crafts as the mega-rich are at extracting wealth from our financial system. And it’s not even close.

Right now, the highest-earning Americans are sequestering money from the economy at a staggering rate. And they’re doing it seamlessly, thanks to financial tools that you literally have never heard of. Tools that even the vast majority of one percenters never get access to. This is sped along by the unapologetic use of tax shelters. It’s all grossly blatant, lightning quick, and teeters dangerously close to breaking the #1 rule of amassing wealth: Make as much money as you can, but not so much that the poor raid your stronghold and you wake up with a pitchfork in your eye socket.

Usually, the insanely-wealthy are good at understanding how much money they can horde without the peasants taking action. That’s basic Scrooge McDuck 101. But when they get it wrong and things get out of whack, there are dramatic corrections until the system is brought back into balance. How do things return to some sense of equilibrium? According to The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century by Walter Scheidel, change comes through widespread calamity. The author and Stanford professor cites “the Four Horsemen” — state collapse, war, natural disaster, or revolution. Looking backward, it’s always one of these and it’s always bloody.

To identify when the wealth gap is growing out of hand, statisticians and economists worldwide use the Gini coefficient — a number that measures inequality based on how wealth is spread across society. When the wealth of the richest citizens leaves the poor too far behind, there is, historically speaking a dramatic reckoning, e.g. death and chaos.

Now take a stab at which country’s Gini coefficient is highest among the Top 10 Richest Nations? If you guessed that it was the US (even though many economists agree that our official Gini number is actually much higher than reported due to mega-rich’s use of tax havens, blatant tax evasion, and a lack of nuance in how the Gini coefficient itself is calculated) then you’re absolutely correct.

Can you hear the bottom 50% percent of earners — disproportionately Millenials — who control a perilously low percentage of our national wealth, sharpening their pitchforks? Is it time to worry yet?

This is the backdrop into which Alexandria Ocasio-Cortez suggested the possibility of a 70% marginal tax rate. Speaking with Anderson Cooper on 60 Minutes last week, she said:

You look at our tax rates back in the ’60s and when you have a progressive tax rate system, your tax rate, let’s say from zero to $75,000, may be 10 percent or 15 percent, etc. But once you get to the tippy-tops — on your 10 millionth dollar — sometimes you see tax rates as high as 60 or 70 percent. That doesn’t mean all $10 million are taxed at an extremely high rate, but it means that as you climb up this ladder, you should be contributing more.

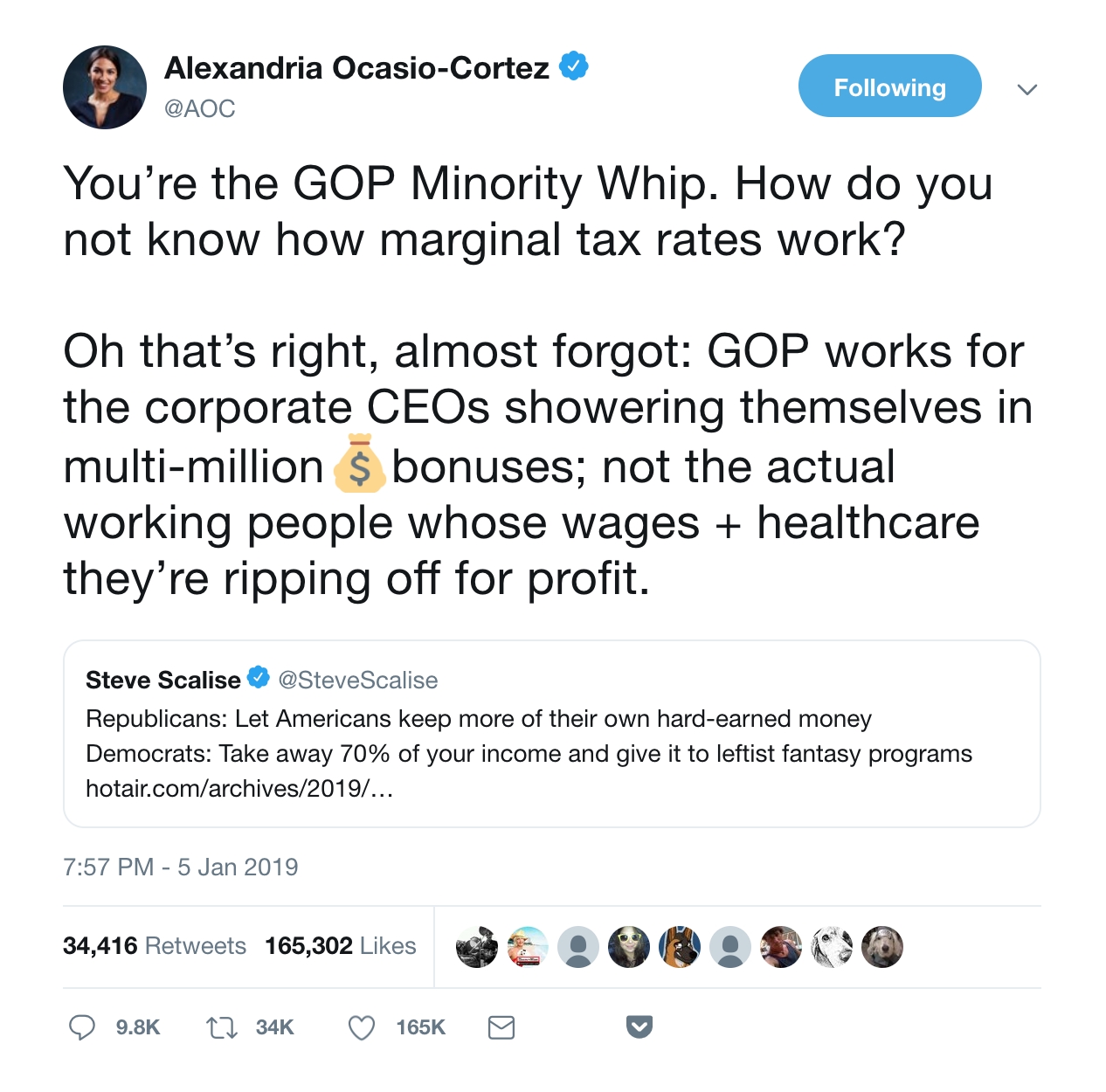

The very suggestion was met with immediate derision and claims of socialism from the right, to which Ocasio-Cortez quickly responded.

As the Congresswoman explained to Cooper, a marginal tax rate doesn’t mean that all of a person’s $10 million yearly income would be taxed at 70%. But Steve Scalise, Fox News, and others seemed to willfully ignore this rudimentary fact. They also ignored history, failing to note that the marginal tax rate was 91% under Republican President Dwight D. Eisenhower. Back then, the top bracket also kicked in far earlier than at the ten-millionth dollar. Adjusted for inflation, it was more like $1.7 million for an individual and $3.4 million for a couple.

And how many people are we talking about here who would be hit hard by a 70% top tax rate? How many of our 247.5 million citizens over the age of 18 would find their fortunes wrecked by contributing more taxes to a system over which they have outsized influence, control a majority of the wealth, and leave a massive footprint on in their quest to gather ever more money?

That’s the number of people who are beyond Ocasio-Cortez’s suggested $10 million/ year top bracket. Roughly 0.0065 % of the populace, many of whom are Democrats. For context, there are four times that many homeless living in New York City right now.

Considering how wealth inequality is linked to other massive societal issues that the cultural conversation is centered on — race, gender, poverty, wage stagnation — it’s shocking how little we understand or talk about it. There’s a whole range of reasons for this:

- It’s complicated. The mega-wealthy are often credited with creating jobs, which adds cash to our economy, but they also remove cash via investments and freeze wage growth in order to satisfy their own investors.

- The machinations of people operating at this level are cloistered, as the Panama Papers revealed.

- No one who has this sort of cash has much interest in us understanding their actions, nor do the politicians to whom they contribute.

- It’s a lot harder to push corporations to stop laying off workers while giving their CEOs multi-million dollar bonuses or track the movements of US money offshore than it is to shame someone on Twitter for saying something clumsy.

Still, what is known about the wealth gap is grim and we need to do our best to understand how it affects us. As Newsweek wrote last week, in response to a SwissBank report on wealth:

Rather than reinvesting and creating jobs as proponents of the widely discredited trickle-down economic theory argue, the super-rich often take money out of national economies and hoard it offshore using tax avoidance loopholes.

That’s not good for the average American. So if you’re one of the many people who longs to build a better nation, it ought to be on your radar. Especially since wealth inequality spiraling out of control so often leads to violence. Because the mega-wealthy have a tremendous amount of control over how our nation operates, but the rest of us have numbers on our side. At the moment, there’s still power in voting and organizing and we maintain the potential to create change.

The actual mechanics of what that change would look like is yet to be seen. It might come through voting in a higher marginal tax rate, as Ocasio-Cortez suggests. Or by continuing to expose the criminal activity of the insanely wealthy (a Panama Papers documentary came out in 2018, a fictionalized version launches this year). Or by voting in (and supporting) political candidates who favor extreme penalties for people hiding money offshore. Or by shopping locally with entrepreneurs who keep money in the system, rather than buying from corporations who reward mega-rich investors with dividends created by squeezing their employees.

The point is, we’ve got to know about the wealth gap in order to take action to fix it. Because the fact that the whole idea is rarely spoken of and easily ignored absolutely thrills the 0.01%. That’s guaranteed. This ignorance allows our Gini coefficient to climb unchecked until society hits a tipping point and people revolt. As Scheidel writes in The Great Leveler, that path never ends well.

[protected-iframe id=”b81af21134fedb3d687209cf926e25c9-60970621-117515348″ info=”https://embed.actionbutton.co/widget/widget-iframe.html?widgetId=SPK-Q0VFRw==” height=”450″ frameborder=”0″ scrolling=”no”]