SHOWS

Covers Books

EVENTS

FEATURED

BRANDS

TRAVEL,

DRINKS & EATS

DRINKS & EATS

Latest

Jennie Adds A New Spin To Tame Impala’s Hit ‘Dracula’ On A Fresh Remix

What is Tame Impala's biggest song? If you're looking at Spotify, "The Less I Know The Better" has over 2.2 billion streams. If you're looking at the Billboard Hot 100, the 2025 single "Dracula" was, somehow, the first Tame Impala song to hit the chart. (The song came out a month before Halloween, which probably helped.) Now, it would seem the single is about to get an even bigger bump, as today (February 6), Jennie of Blackpink fame has hopped on a new version of the track. The song isn't much of a remix in the sense that the instrumental…

Maisie Peters Links With Amelia Dimoldenberg And Benito Skinner For Her New ‘My Regards’ Video

Maisie Peters is on a roll. In 2023, she released her second album, The Good Witch, which was her first to go No. 1 in her native UK. In 2024, she was an opener on some of the year's biggest tours: Taylor Swift, Coldplay, Noah Kahan, and Conan Gray. She's set to once again make 2026 her year, as she recently announced Florescence, a new album set for May 15. Today (February 6), she shares a new single, "My Regards," and a video. Amelia Dimoldenberg, of Chicken Shop Date fame, directs, while Benito Skinner stars alongside Peters. In a statement,…

Robyn Is Going On Tour With A Bunch Of Great Openers, Including Lykke Li And Romy

Robyn has an anticipated new album, Sexistential, ready to drop towards the end of March. After giving fans a few months to digest the project, Robyn is going on The Sexistential Tour, which she just announced today (February 6). The run spans from June to November, with the North American stretch hitting Washington DC, Brooklyn, Chicago, Toronto, Mexico City, and Los Angeles in September. She has a huge and great set of openers that features Erika de Casier, Smerz, 808 State, Saya Gray, Mechatok, Romy, Zhala, Becky and the Birds, Nourished By Time, Peaches, Grace Ives, Lykke Li, and horsegiirL.…

Sombr Returns With ‘Homewrecker’ And A Western Video Co-Starring Quenlin Blackwell And Milo Manheim

Sombr had a massive 2025 with the release of his debut album, I Barely Know Her, which made the top 10 of the Billboard 200 chart. At the very end of 2024, lead single "Back To Friends" was a breakout hit, becoming his first single to hit the Hot 100 chart, doing so with a peak at No. 7. It was also one of the top songs of 2025 on Spotify. His 2026 is getting off to a great start, too. He was a show-stopper with his performance at the Grammys last weekend. Today (February 6), he returns with "Homewrecker,"…

‘Boyfriend On Demand’: Everything To Know About Jisoo’s New Netflix Rom-Com Series

Jisoo is best known as one of the members of Blackpink, of course, but she's been getting more into acting over the past few years, too. She had leading roles in the TV series Snowdrop and Newtopia, as well as the movie Omniscient Reader: The Prophecy. Now she's getting back in front of the camera again, in another new show, Boyfriend On Demand. The series was initially developed for the leading South Korean TV station MBC, but Netflix, likely motivated by Jisoo's star power, picked up the show. So, while some of Jisoo's other acting work has been tough to…

Uproxx’s Joypocalypse Discusses How Circle Jerks Made Punk Harder And Faster

The initial dissolution of Black Flag was tough for fans to swallow. What made it go down easier, though, was that the group's Keith Morris had another great band going, too: Circle Jerks. Forming in 1979, the band helped spearhead a new aggressive era for punk music. Their impact was immense and their work lived on in subsequent generations, as everybody from Red Hot Chili Peppers to Pearl Jam to the Offspring have cited them as an influence. As Uproxx's Joypocalypse notes, the band was "part of the first wave that turned punk into something harder, faster, and more agro."…

Miss Piggy Insists There’s No Beef With ‘Muppet Show’ Co-Star Sabrina Carpenter After Getting ‘Arrested’ At Her Concert

At the end of her Short N' Sweet Tour in November 2025, Sabrina Carpenter capped off her tradition of making fake arrests by putting one more celebrity in custody: Muppets icon Miss Piggy. Now, the puppet herself is addressing if there's any lingering beef with her The Muppet Show co-star. In a chat with TV Insider (here's the video), the interviewer asked if Carpenter being on the show meant she and Miss Piggy had made up following the arrest. Miss Piggy noted the show was actually filmed before that concert moment but went on to say, "I mean, you know,…

We Tried Papa Johns New Pan Pizza Ahead Of Super Bowl Weekend

Super Bowl LX touches down in just four days, so it’s time to figure out your game plan. No, we’re not talking about where you’re watching or who you’re watching with. We’re talking about the most important thing about any Super Bowl party — what does the food spread look like? You have to make sure you have the best person in your circle on salsa, guacamole, and drinks duty, but above all else, you need the best pizza your money can buy. Which means it's time to reignite the age-old debate over which of the big pizza brands is…

Charli XCX Fails At Prank-Calling Role Model And Dakota Johnson In A Hilarious Video

Charli XCX has been a big-time player in the music industry for well over a decade at this point. Between that and her explorations of acting and other branches of entertainment, she's compiled quite the list of contacts. She just exploited that in a new video for Elle, in which she prank-calls some of her famous friends. She begins by calling Dakota Johnson, telling her that she needs to house a horse that her husband (The 1975's George Daniel) won at a party. She begins by asking Johnson if she likes animals before telling her about the fictional horse and…

Mitski Announces A Big World Tour As She Shares A Chaotic Video For The New Song ‘I’ll Change For You’

We have a good news-good news situation. The good news is that the album Mitski teased recently is called Nothing's About To Happen To Me and it's set to drop at the end of this month. The also-good news is that now, she has announced a tour in support of the project. The global shows run from March to July and will feature support from Haley Heynderickx, Gustaf, and others. Tickets are available for pre-sale starting February 11 at 10 a.m. local time, followed by the general on-sale on February 13. Pre-sale details vary between cities, so find more information…

Sabrina Carpenter Builds The Perfect Man In A Terrific New Super Bowl Commercial For Pringles

Sabrina Carpenter is one of the biggest pop stars of the current age, but she has also used her spotlight to remind the world that she's a skilled actor and is very funny, too. Her on-stage antics are hilarious, and over the past year, she's become a bit of a mainstay on Saturday Night Live, popping up for an unannounced cameo last month. Carpenter hasn't gotten her own Super Bowl Halftime Show yet, but she will be seen during the big game in a new Pringles commercial. The extended version of the ad is out now and it starts with…

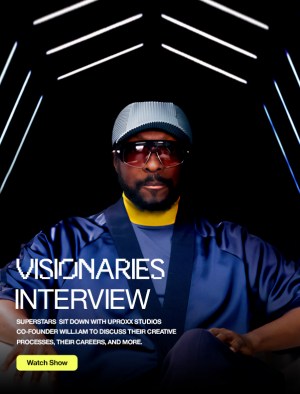

will.i.am and UPROXX Brought Together A Star-Studded Council To Imagine The Future Of Music & Tech

will.i.am, in collaboration with UPROXX and the AI-powered productivity app FYI, brought together a star-studded council of friends, creatives, and innovators for the premiere VISIONARIES event ahead of the Grammys to discuss the future of technology in music and the arts. This Jedi Council of creatives included rappers, actors, Olympians, and multi-hyphenate talent. Miles Minnick, Symba, D Smoke, RJ Cyler, Dr. Luke, Jeremiah Brown, Michelle Rodriguez, Natasha Lyonne, and The Game all spoke on subjects ranging from designing creative leverage to interfacing with AI. The conversation comes at a critical time as AI technology is rapidly expanding, and artists are figuring…

Heineken House Is Bringing Wale, Sean Paul, Big Boi, And More To Coachella 2026

Coachella is one of the biggest festivals in the world. It's so big, in fact, that there's at least one festival happening within the festival, as Heineken is once again hosting Heineken House at Coachella 2026. The show runs for all three days of both weekends, from April 10 to 12 and 17 to 19, and is led by Wale, Sean Paul, and Big Boi, as well as Coi Leray, Motion City Soundtrack, and plenty of others. If you're already at Coachella, there's no additional cost to visit Heineken Hous. Guilherme de Marchi Retz, Marketing VP of Heineken at Heineken…

Harry Styles Lands His Third No. 1 Single As ‘Aperture’ Debuts On Top Of The Hot 100 Chart

After a few years of staying largely out of the spotlight, Harry Styles returned in a big way with the new single "Aperture," from his upcoming album Kiss All The Time. Disco, Occasionally.. Clocking in at over five minutes, many of which are more of a slow burn than an in-your-face pop banger moment, the song doesn't exactly follow the big pop single formula. It's Harry Styles and it's a strong song, though, so it worked anyway: On the new Billboard Hot 100 chart dated February 7, "Aperture" debuts at No. 1. The song is Styles' third chart-topper, following "Watermelon…

Hayley Williams’ New Band Power Snatch Unexpectedly Drops Its Debut Release, ‘EP1’

Hayley Williams was all over the 2026 Grammys last night (February 1) as she had four nominations: Best Rock Performance for "Mirtazapine," Best Rock Song for "Glum," Best Alternative Music Performance for "Parachute," and Best Alternative Music Album for Ego Death At A Bachelorette Party. She came up empty, unfortunately, but she doesn't seem too bummed about it. In an Instagram post, she wrote, "We’d like to thank the academy. (And it’s an honor to lose to The Cure anytime) Love, Hayley Williams, Daniel James & Steph Marziano." In the photo, those three are all standing with their hands up…

The Best Physical Media Releases Of January 2026

Streaming services are the primary way a lot of people consume their media of choice, whether that be music or TV shows or movies. Not everybody is on board, though, and some who are are getting tired of it. Regular price increases and limited streaming libraries have some consumers returning to physical media, preferring vinyl and CDs and DVDs and more, objects they can hold and own without fear of losing access, either in conjunction or instead of streaming options. Companies are more than happy to support this wave: Whatever you might be into, each month brings a slew of…

Sombr, Alex Warren, And The Rest Of The Best New Artist Nominees Joined Forces For A 2026 Grammys Medley

The slate of performers at last night's (February 1) 2026 Grammy Awards was a big one. Bruno Mars was one of the evening's highlights, but so too was every Best New Artist nominee, as they all performed during a special section of the broadcast. It started with The Marías performing "Nobody New" (here's a video), then Addison Rae danced her way through "Fame Is A Gun" (video). Katseye got some dancing in, too, with "Gnarly" (video), then it was Leon Thomas' turn to do his breakout hit "Mutt" (video). Alex Warren then busted out "Ordinary" (video) before Lola Young took…

Bruno Mars Owned The 2026 Grammys With Two Performances, Including A Rosé Reunion

It's a good time to be Bruno Mars right now. His and Rosé's "APT." was one of 2025's biggest songs and his recent single "I Just Might" is No. 1 on the Hot 100. A few days ago, he was also the final name added to the performance lineup at this past weekend's 2026 Grammy Awards. The ceremony went down last night (February 1) and Mars was all over it. At the top of the show, he reunited with Rosé for a riveting rendition of "APT." (here's a video), which say Mars lean into his musicality and rip a guitar…

Uproxx’s Jeremy Hecht Discusses J. Cole’s Final Goal Before Retiring

J. Cole is days away from releasing his latest album, The Fall-Off, on February 6. The way Uproxx's Jeremy Hecht sees it, he thinks Cole is retiring after this project, but he hopes to do so having accomplished one final goal. https://www.instagram.com/p/DT55c4IjhcA/ In a new video, Hecht starts, "We all know that Cole dropped out of the battle with Drake and Kendrick, and with that, he did give up his ability to gain the crown as the greatest rapper alive. Some people like Fat Joe can't even listen to his upcoming project, and I think that's stupid: I'm excited for…

Bruno Mars Is The Final Name Added To The 2026 Grammys Performance Lineup

In recent days, the Recording Academy has been gradually rolling out its list of performers for the 2026 Grammy Awards (set to air on February 1). Today (January 30), days before the ceremony, they added one more name to the list: Bruno Mars. As Billboard notes, he's the last performer that will be announced. He joins a performance lineup that also includes Addison Rae; Alex Warren; Andrew Watt; Brandy Clark; Chad Smith; Clipse; Duff McKagan; Justin Bieber; KATSEYE; Lady Gaga; Leon Thomas; Lola Young; Lukas Nelson; Ms. Lauryn Hill; Olivia Dean; Pharrell Williams; Post Malone; Reba McEntire; Rosé; Sabrina Carpenter;…

The Grammys Should Catch Up To PinkPantheress

In 2025, we received exceptional projects from Black women in electronic dance music: Kelela equipping her talents for an enchanting jazz-filled live album, hypnotic club grooves from Rochelle Jordan, Amaarae's ode to Black diasporic dance music, Sudan Archives' sensual fusion of techno and house, two albums by FKA Twigs for the pregame/afters, and keiyaA's layered experimental sophomore album. These projects are often applauded by other Black women and femmes while simultaneously acknowledging the reclamation of dance music's inherently Black roots. In the music industry, Black women have to work twice as hard to bend the limitations of genres, and that…

These Essential Latin Music Video Directors Are Driving A Creative Revolution

As music approaches language and genre-fluid territory, those working behind the scenes are as essential to the process as the artists themselves. Latin music has long served as an outlet for both emotion and celebration, and visuals for artists like Bad Bunny, Omar Apollo, and Karol G have proven to be equally powerful. Many of these artists have remained with their visual collaborators for years, displaying excellent creative chemistry. As these musicians' creativity evolves, the directors of their music videos have grown alongside the singers' and rappers' craft. Consistency is a key component of Latinidad and work ethic, and below,…

Hayley Williams Is Indefatigable As She Launches Another New Project, A Band Called Power Snatch

Hayley Williams has been going pretty much nonstop the past few years. Paramore dropped their latest album, This Is Why, in 2023. The band spent some of that year and next opening for Taylor Swift on The Eras Tour. In 2025, she released a series of singles that ended up comprising the album Ego Death At A Bachelorette Party. Well, new year, new project: Williams just unveiled a new band, Power Snatch. It's a duo and the collaborator is a familiar one: Daniel James, who was heavily involved in writing and producing Ego Death At A Bachelorette Party. So far,…

The Emotionally Heavy (And Likeable!) Indie Rock Of Ratboys

If you know anything about the Chicago indie-rock band Ratboys, it probably concerns their likeability. Ratboys are a likeable band. They are likeable because they make really good music, and they are likeable because they have made really good music consistently over the course of 11 years and six albums. (Their latest, Singin' To An Empty Chair, arrives February 6.) But they are also likeable because they work hard, they travel pretty much anywhere and everywhere, and they do their jobs with kindness and professionalism. They are likeable the way your mailman is likeable. The "Ratboys are likeable" narrative is…