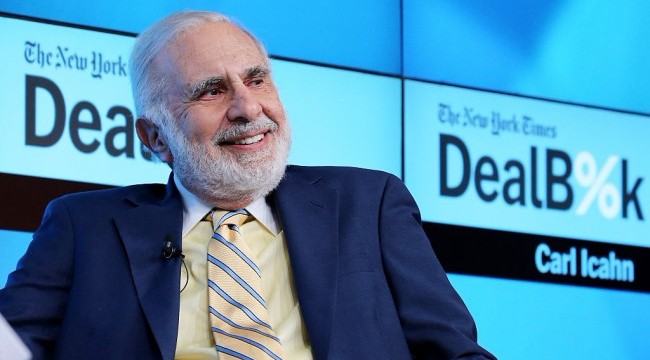

President Trump has drawn the ire of a number of Republicans, including Speaker of the House Paul Ryan and soon-to-be-former economic advisor Gary Cohn, over his announcement of steel and aluminum tariffs. However, included in all this chaos is news that billionaire and close Trump advisor Carl Icahn, who’s already been raising eyebrows with his business practices since President Trump took office, sold over $31 million worth of stock in a company heavily dependent on steel imports days before President Trump announced his new tariffs.

The share price of Manitowoc Company, a crane and lifting supplier, fell by over 5% after Trump’s announcement, but Icahn, who had started selling his shares in the middle of February, was able to sell a portion of his stock while the share price was still between $32 and $34. Furthering suspicions, Icahn had gone over three years without buying or selling any other stock in Manitowoc Company.

Icahn is denying he knew anything about the steel tariffs:

“Any suggestion that we had prior knowledge of the Trump administration’s announcement of new tariffs on steel imports is categorically untrue. We reduced our position in Manitowoc for legitimate investment reasons having nothing to do with that announcement.”

Icahn declined to mention whether he has sold any additional stock.

(Via Axios)