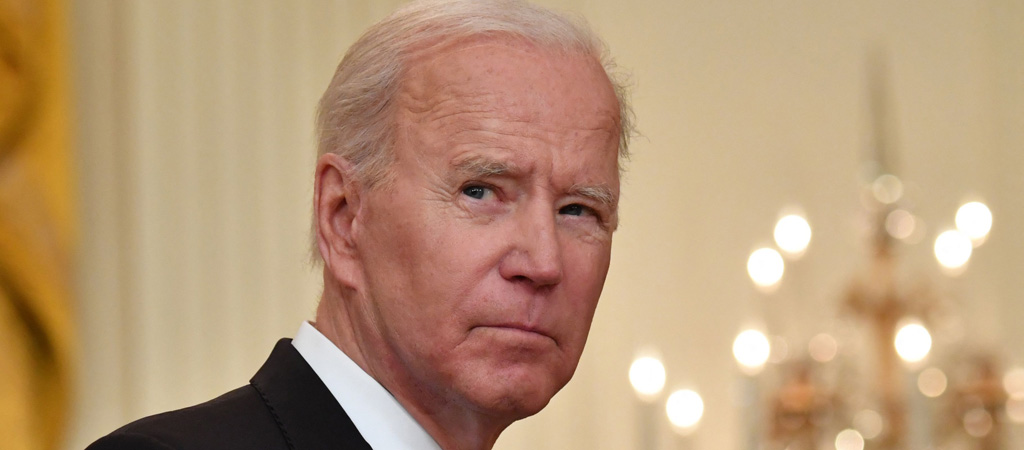

During the 2016 presidential debates, then-GOP candidate Donald Trump proudly boasted—twice—that he doesn’t pay federal income taxes. Why? Because he’s “smart.” It was a bold, and frankly dumb, statement coming from a wannabe president. But it spoke to a larger truth in this country about billionaires and their money: Those who have the most of it don’t often like to part with even a penny of it. Which explains why, as Raw Story reports, so many billionaires are up in arms about President Joe Biden’s proposal to raise the richest one percent’s taxes.

As Raw Story wrote:

Biden’s plan is to issue a minimum of a 20 percent tax on billionaires. It comes after a 2021 report by ProPublica that revealed “a vast trove” of leaked Internal Revenue Service (IRS) documents that showed billionaires like Jeff Bezos and Elon Musk have all avoided paying any federal income tax for several years, despite raking in cash.

That report revealed that Musk’s tax rate was at 3.27 percent, whereas Bezos’ had just 0.98 percent.

If you’re currently thinking: Wait, that’s a hell of a lot less than I currently pay, you’re undoubtedly right.

While, from a logical standpoint, it would make sense that the more money you make, the more you’d pay in taxes, try telling that to the billionaires of the United States. As Insider reports, part of Biden’s plan would include taxing unrealized capital gains, or assets that are regularly increasing in value but are not taxed until they are sold off. When questioned about that part of Biden’s proposal specifically, billionaire investor Leon Cooperman didn’t mince words: “I would say it’s stupid,” Cooperman told Insider, adding that: “It’s probably illegal. It won’t pass… They should stop attacking wealthy people and attack the tax code. They’re so ignorant.”

While Cooperman said that he doesn’t “mind paying taxes,” he takes a philosophical view to it and says “we don’t need new forms of taxation just reform the existing tax code.”

If Biden’s so-called “Billionaire Minimum Income Tax” proposal passes, Fox News reports that it will “would reduce the deficit by about $360 billion over the next decade, representing more than a third of the Biden team’s plan to trim the spending gap by $1.3 trillion.” Which sounds like a good thing—unless you’re the one who’s going from paying virtually zero dollars in taxes to 20 percent.

But Biden’s not ready to back down. In an official statement issued by the White House, the Biden administration noted that: “President Biden is a capitalist and believes that anyone should be able to become a millionaire or a billionaire. He also believes that it is wrong for America to have a tax code that results in America’s wealthiest households paying a lower tax rate than working families.”

(Via Raw Story)