Silicon Valley Bank (SVB) fell hard. For some in the financial realm, there was a great cloud of paranoia sweeping over the land, a fear that this could domino effect the global economy into a recession much like 2008. For others, just chilling, trying out a new Smoky Negroni Cocktail and brainstorming where to find the best grilled chicken sandwich, the reaction might be: “What the hell is The Silicon Valley Bank?”

As the name suggests, it’s a popular bank in Silicon Valley, and it’s known for sponsoring startups and tech innovation. And, well, a few weeks ago it got pulverized. Billions lost, and news outlets claim social media had a large role to play in it. It was even labeled as the first ever “Twitter-fueled run on a bank,” a fascinating technological phenomenon.

This was the bombshell news of March, so let’s explain what happened in simple English.

WHAT IS SVB?

Silicon Valley isn’t just known as the place for world-changing tech innovation, it’s also a hub for all kinds of startups. That’s why it’s the “Capital” of Venture capital (privately investing in startups). SVB is a startup/tech-friendly bank, and thus, many of the entrepreneurs of Silicon Valley take their businesses to SVB.

In fact, PBS reported, “SVB claimed to have approximately half of all U.S. venture-backed tech and life science companies, and more than 2,500 venture capital funds as its customers.” 2020 became a golden age for startups, the result being that these businesses gave SBV a lot of money. But why was it a golden age?

THE COVID OPPORTUNITY:

TLDR; Covid really F-d up everything, and torched the economy. It turns out, a strategy to heal a barren economy is to make borrowing money easy (Lowering Interest Rates). Because, if you can borrow money for cheap, the idea is that people are much more likely to go get a big loan, build/plant something and help the fields flourish with money again. Outlined by CNBC, that’s what the government did, lower interest rates, basically to zero.

What happened next? According to Forbes, LOTS of companies took the opportunity to take part in a ” Startup Frenzy,” and, as we mentioned, SVB was a hub for this. What does one do when they get a lot of money? Naturally, they might try to make more money.

LOOSE BANKING:

When one puts money in the bank, it’s not just sitting in a vault. Banks are deploying that money in hopes it multiplies. To the criticism of many politicians like Elizabeth Warren, some banks, like SVB, are not policed that heavily and can more freely deploy cash to make a profit. One strategy to make a profit is buying Treasuries (IOUs from the government). These IOUs are appealing because the government guarantees to pay you back in full IF you wait (sometimes a few months, sometimes a few years, and sometimes a decade, there are different types.) While you wait, the government pays out some returns (a low-interest rate means small returns, a high-interest rate means bigger returns).

Outlined by this CNN article, once SVB got their hands on a boatload of money from entrepreneurs in Silicon Valley, they started gambling billions on these IOUs. Then something went wrong.

THE “OH SH*T” MOMENT:

Remember that strategy about making the fields flourish with money? It turns out, that barren field can get overgrown with weeds — AKA too much money AKA inflation. A method to “burn the field” is for the government to increase the interest rate. That’s what happened in 2022 and it was abrupt. Two things happened:

- It became much harder for these tech companies to get easy access to cash and stay afloat. As their stock prices started dropping, these companies were forced to withdraw funds from their bank accounts at SVB to keep daily operations going.

- When the interest rate went up, the IOUs that SVB had spent a fortune buying lost a ton of value. But that’s okay! As long as SVB waited it out, the money would be paid back, and all would be right and dandy. Except…

When these companies under fire pulled up to the bank and said, “Hey I kinda need my money right now, things are getting tough.” SVB was like, “Ah, the thing is, we kinda made a deal/bet with the gov, and if we back out now, we’re gonna lose a lot of money.”

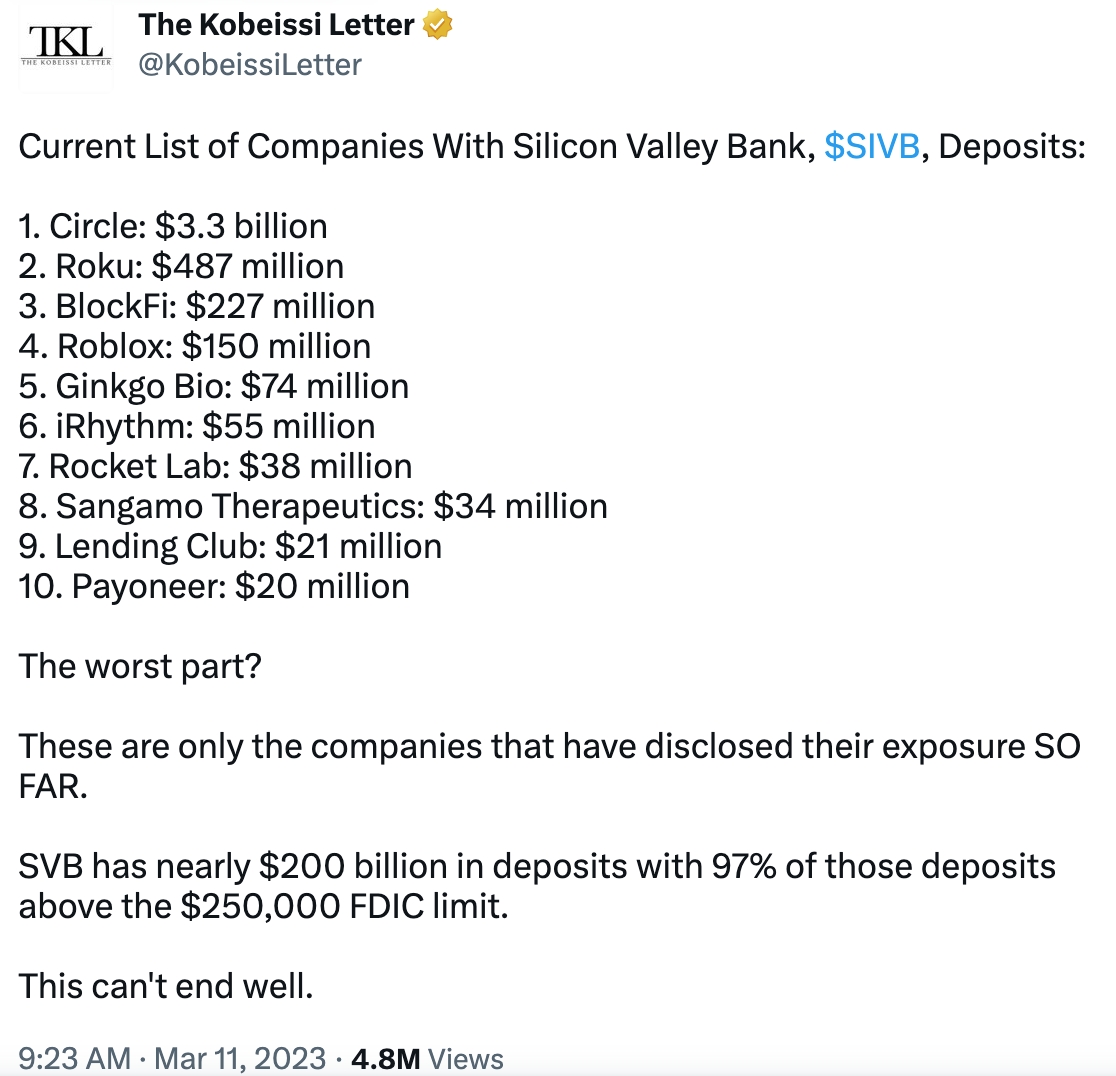

Too bad, SVB had to sell their IOUs and take a big loss — a huge loss actually: billions of customer dollars. Then, the rest of the companies using SVB realized, “Oh, sh*t, I might lose my money. Time to bail.” And then, panic ensued.

THE CLIMAX: SPONSORED BY TWITTER

According to CNN, “multiple prominent venture capitalists took to Twitter and used their large platforms to raise alarms about the situation, sometimes typing in all caps. Some investors urged startups to rethink where they kept their cash.”

What happened then, was an old-fashioned run on the bank, only this time, the power of social media allowed the panic to spread like wildfire. Additionally, modern banking apps allowed people to react fast and withdraw money with the click of a button. The result: “42 Billion dollars of funds were withdrawn in a single day. House Financial Services Chair Patrick McHenry later described it as “the first Twitter-fueled bank run.”

SVB couldn’t return everyone’s money and government regulators (The FDIC) seized control of it. This was deemed the biggest bank failure in the US since the financial crisis of 2008 and sent ripples across the economy, causing the collapse of both Credit Suisse in Switzerland and US lender Signature Bank.

THE AFTERMATH:

While many customers panicked, on March 12th, CNN reported that regulators would insure that customers would regain access to their funds, and worked hard to put SVB up for sale. There was speculation about who would buy SVB (even Elon Musk threw his hat in the ring) but the government made it clear they wanted another bank, not an individual, to purchase it.

The BBC reported that on Sunday, March 27th, First Citizens purchased “$72bn of SVB’s assets at a discount of $16.5bn – a deal that will make the bank one of the 25 biggest in the US.” This put a close to the SVB saga. As they say, all’s well that ends well.

GOING FORWARD:

Beyond the financial hindsight of this whole fiasco, outlined in this Boston Globe article, a huge takeaway from all this is the power of social media. The ability to seamlessly spread information has completely changed the scope of things in the last few decades; it’s now easier to connect, educate, and access the lexicon of the human experience. But just as lowering and raising interest rates has its pros and cons, so too does powerful interconnectivity enabled by technology. In the grand scheme of things, lightning-quick mass media is still relatively new, and we just got a first taste of a seismic financial panic — fueled, in part, by an app. It’s a powerful new modern phenomenon and its impact will only continue to evolve.