WWE has released their earnings report for the final quarter of 2019 and the full year, and there are a lot of complicated numbers involved. Revenues for the company over that final quarter increased 18% to $322.8 million, the highest quarterly revenue in WWE history. WWE’s operating income increased a whopping 87%, to $99.8 million. The adjusted OIBDA (Operating Income Before Depreciation and Amortization) increased 67% to $107.6 million, which is also a quarterly record.

Revenues for the year came to $960.4 million, the highest WWE has ever had in a year. Operating income was $116.5 million. The adjusted OIBDA of $180.0 million made this the third year in a row that WWE has beaten its own record.

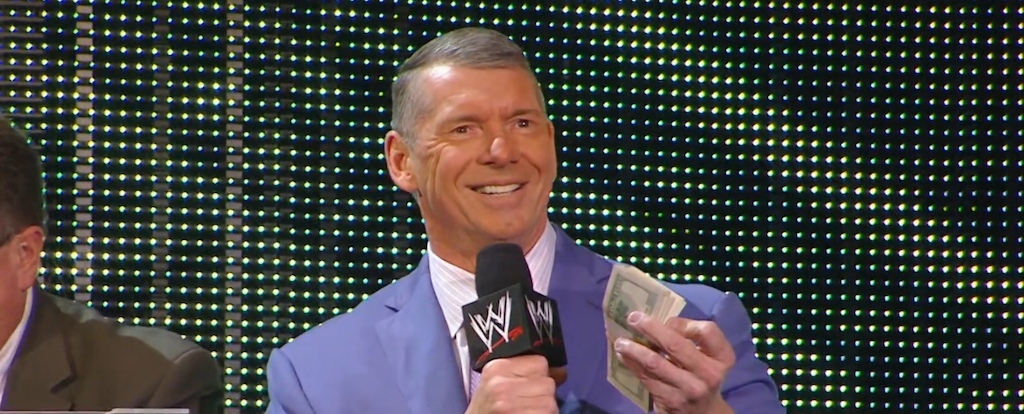

Focusing on the positive, Vince McMahon had this to say:

During the fourth quarter, we expanded the reach of WWE’s live programming and further engaged with diverse audiences across platforms and formats. We believe the value of live sports will continue to increase, particularly in today’s evolving media landscape, and we are well positioned to take advantage of this trend to maximize the value of our content.

However, despite the company’s substantial profits, there were some less encouraging numbers within the report. Profits from live events declined heavily in 2019, which fits with ongoing rumors about WWE making plans to change how they do house shows.

WWE also noted that paid subscriptions to the WWE Network decreased by 10%, to 1.42 million subscribers. That means the network lost $14.7 million in revenue in 2019. In the hopes of increasing profits in 2020 and beyond, the report mentioned WWE’s plan for “the evaluation of strategic alternatives for the Company’s direct-to-consumer service, WWE Network.” Who know what that means.

WWE’s profits from “consumer products” were also down, which they attribute the negative reception for the 2K20 video game.

Basically the theme of this report is that WWE made so much money off of TV deals that they can report record profits despite being down in so many other areas. The question is whether those TV deals will be worth as much in years to come if other areas don’t improve.