By age 35, the saying goes, you should have at least twice your salary saved for retirement. But that pearl of wisdom seems more like a joke to millennials. Retirement? Not in this life.

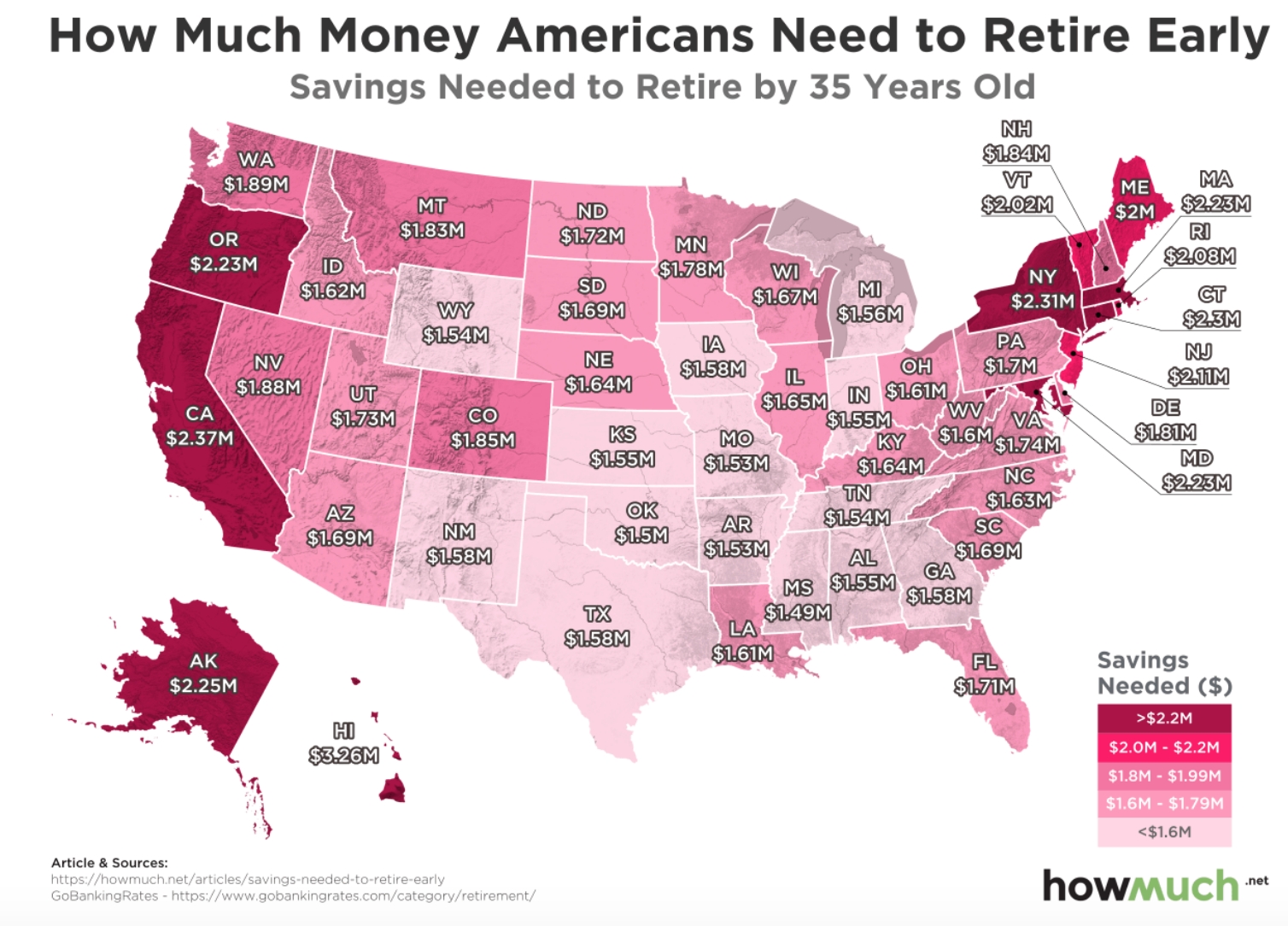

Ours is the generation that expects to work until we die. Or maybe a few weeks after. Now HowMuch has published a state-by-state map of how much you need to save in order to retire early, rubbing salt in the wound. Retire early. As in: not only retire but before you’re 65.

“You might not need as much money as you think to retire early, according to our new set of maps,” the HowMuch article states, seriously, without a hint of irony. This comes right after the map that shows that you would need a cool $1.4 million to retire at 55 in Mississippi. Mississippi! The state with the lowest cost of living!

If you want to retire in Hawaii by the time you’re 35, make sure you have at least $3.26 million in your bank account. If you want to retire to a nice cabin in the wilds of Vermont at 45-years-old so you can focus the last, say, 30 to 40 years of your life on skiing and making jam, you better have $2.17 million.

Meanwhile, as of 2017, 57 percent of Americans have less than $1,000 in savings, and 39 percent have no savings at all. Plus, the average student loan debt for students graduating in 2017 was $28,650 for those who attended public or nonprofit schools and $32,300 for those who attended private schools, per Student Loan Hero. But hey, we can dream while being crushed by late capitalism, can’t we?