Thinking about moving to [insert literally anywhere in the United States]? Well, good luck, because chances are high that no matter what city or town you decide to call home, the cost of rent is going to gobble up most of your funds unless you’re making well above minimum wage. According to an annual study by the National Low Income Housing Coalition, as of now, there isn’t a single state, city, town, or county in the U.S. where you can realistically afford a modest apartment while earning statue minimums.

The National Low Income Housing Coalition (NLIHC) has been documenting the disparity between renters’ earnings and rental costs across the country for 30 years, but their most recent report (published Tuesday) reveals a harrowing reality. According to calculations done by HuffPost, with a federal minimum wage of $7.25 you’d need to work 127 hours a week, or you know, three-full time jobs and about seven hours of overtime, just to afford a modest two-bedroom rental without spending more than 30% of your salary. For all the bachelors out there, that math equals out to 103 hours a week to afford a one-bedroom, and you probably know all too well how much it costs to afford a studio — because if you live in a major city you’re probably currently sharing one.

You might be scoffing to yourself right now, “Pfft, I make more than minimum wage.” Good on you, but that doesn’t mean that you’re immune to the effects of higher rents. According to CNBC, in 1960 the average rent in America was just $71 — $589 adjusted for current inflation — which is about half the going rate of a decent studio apartment in Los Angeles; let’s not even get into pricier cities like New York or San Francisco.

Obviously, access to affordable housing is significant for more than just keeping the amount of money you have in your bank account from giving you a panic attack. It’s been shown to provide individuals with safer, and more stable lives which results in better physical and mental health outcomes, increasing an individual’s opportunity for upward mobility. These things matter in a world where quality of living is being looked at as a more and more important metric of happiness.

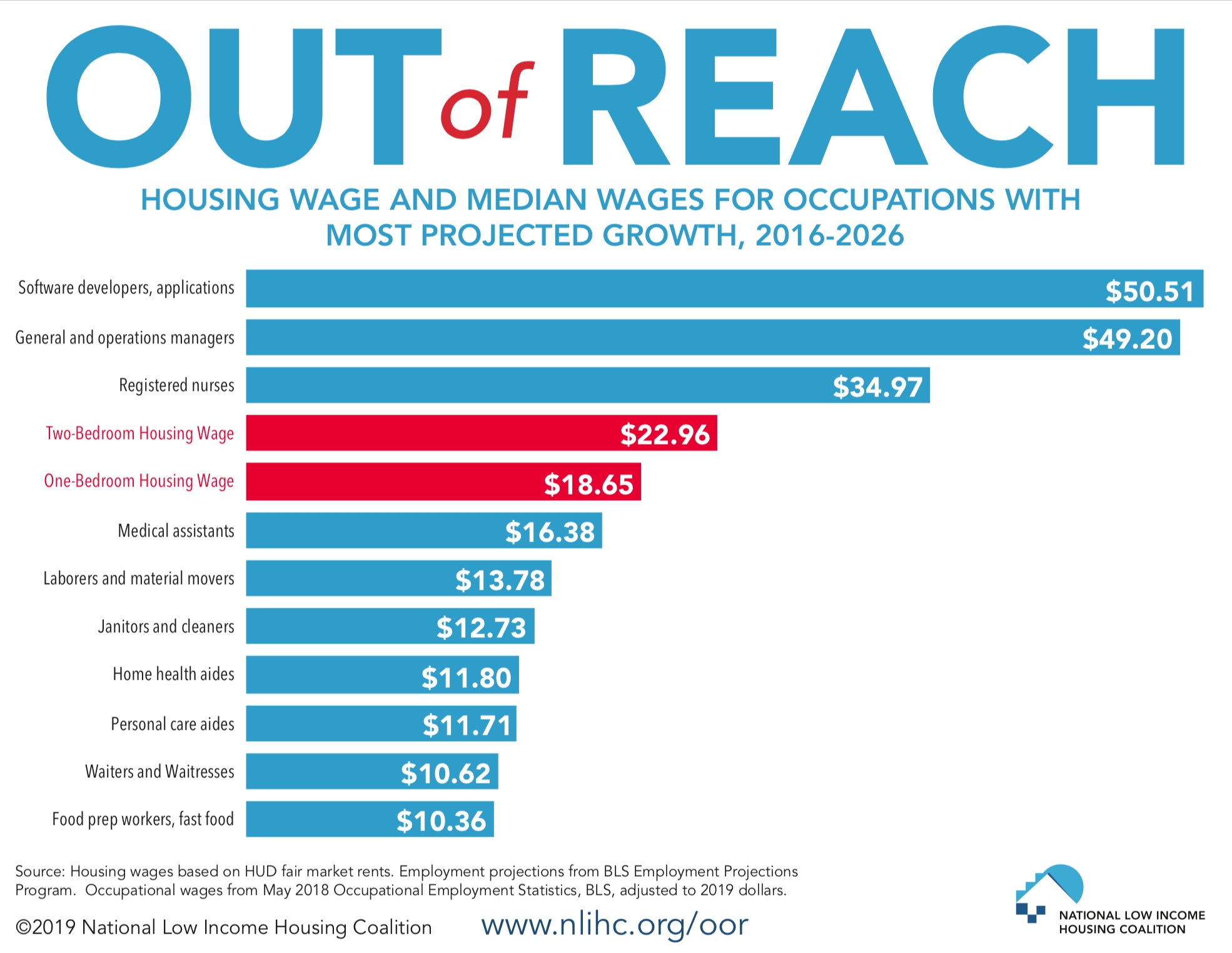

The report uses what is known as “fair market rent” — defined by the Department of Housing and Urban Development as the best estimate of what a person moving today should expect to pay — of modest one and two-bedroom rentals and then calculates the hourly wage a renter would need for it to be considered affordable (under the 30% threshold). According to estimates from the report, a full-time worker would need to make a minimum hourly wage of $22.96 for a two-bedroom, and $18.65 for a one-bedroom. Our current federal minimum wage is $7.25.

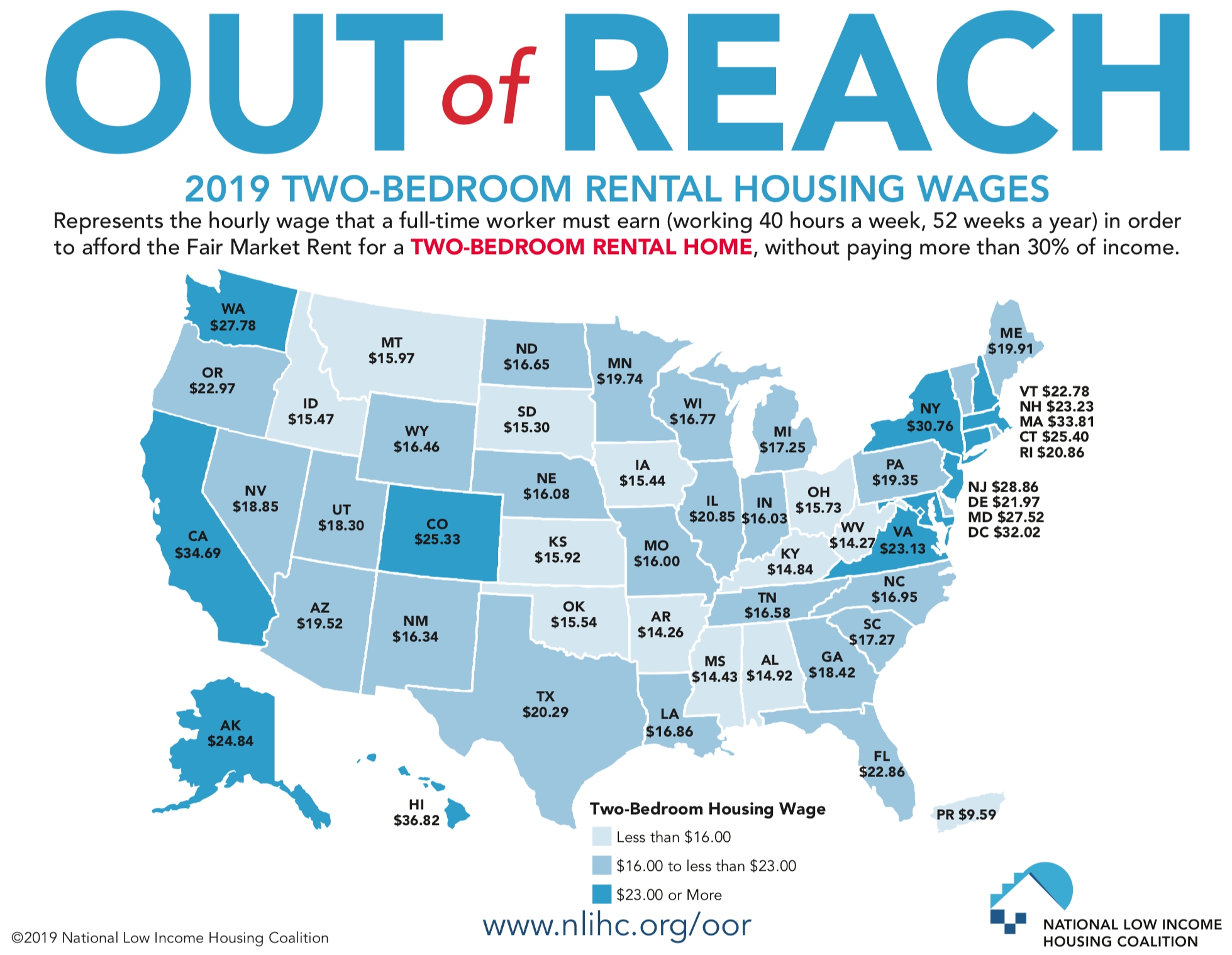

Obviously, unaffordability is not uniform across every state in the country. Hawaii, one of the most expensive markets, lists a modest two-bedroom at $1,914 a month, which means you’d have to make at least $36.82 an hour to not pull your hair out every time you’re about to pay rent. If you think that’s rough, expensive cities like San Francisco require an hourly wage of $60.96 to live comfortably. Splitting that with a roommate, you’d have to both be pulling in at least $30.48 an hour each. Ouch. The current minimum wage in San Francisco is just $15.

Even in more affordable markets like Arkansas, things are looking grim — a modest two-bedroom only runs you $742, but that would require a job that pays at least $14.26 an hour, in a state whose minimum wage is just $9.25. The study breaks down the median wages of the occupations with the most projected growth in the next decade. Sadly, internet writers didn’t make the list.

Also troubling, though not at all surprising, the study also highlights racial disparities. “The housing crisis most negatively impacts low-income people of color, and that’s because they are more likely to be renters, they are more likely to be extremely low-income renters and they’re more likely to be extremely cost-burdened as renters,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition, to HuffPost.

The report recognizes that the median black and Hispanic worker earns 27% less than the median white workers, though it should be noted this didn’t take into account gender. Check out the full report for even more eye-opening (and depressing!) statistics and start saving every cent you can.