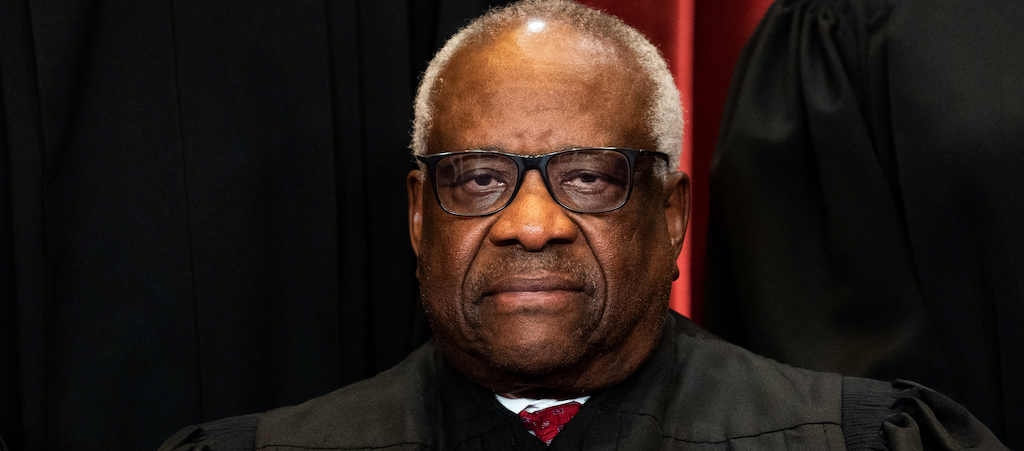

Over the last few months, the public has learned a lot about Clarence Thomas’ lavish lifestyle. A Supreme Court justice in 2023 makes just under $300,000 a year — a pretty penny but by no means highfalutin’. And yet the Republican justice lives high on the hog, thanks to wealthy friends — one of them really into Hitler memorabilia — whose fancy gifts he’s never disclosed, as he’s supposed to. Now we’re learning about one of his rich person toys, which seems to have come to him by shady means.

A new report by The New York Times delves into exactly how Thomas came to own what’s described as a “really bougie” R.V. In 1999, Thomas got himself a Prevost Marathon, a giant, bus-like vehicle that’s called a “condo on wheels.” At the time, the Prevost cost $267,230. Thomas’ salary at the time was $167,900, which was his and his wife’s primary source of income. At the time Thomas was also carrying a lot of debt.

How did Thomas come to purchase such a pricey gift? With a little help from another of his rich friends who works in a powerful industry.

As per NYT, the purchase was at least partly underwritten by Anthony Welters, a longtime pal who made his fortune in the healthcare industry. It was a loan, but it’s unclear if Thomas ever paid the large sum back, with Welters only saying, vaguely, that “the loan was satisfied.” Welters refused to go into any more details nor did he provide any documentation of the loan or its possible repayment.

Much like the fancy gifts Thomas received from his Nazi memorabilia-collecting bud Harlan Crow, Thomas didn’t report any of this either. Whether he had to or not is muddy:

Vehicle loans are generally exempt from those reporting requirements, as long as they are secured by the vehicle and the loan amount doesn’t exceed its purchase price. But private loans like the one between Mr. Welters and Justice Thomas can be deemed gifts or income to the borrower under the federal tax code if they don’t hew to certain criteria: Essentially, experts said, the loan must have well-documented, commercially reasonable terms along the lines of what a bank would offer, and the borrower must adhere to those terms and pay back the principal and interest in full.

According to Richard M. Painter, a White House ethics lawyer circa the Bush II era, “justices just should not be accepting private loans from wealthy individuals outside their family.” If they do, as Thomas did in the case of his R.V., “you have to ask, why is a justice going to this private individual and not to a commercial lender, unless the justice is getting something he or she otherwise could not get.”

For the record, Thomas did recuse himself from two cases involving United HealthCare when Welters was one of its execs. But both Thomas and Welters’ refusal to go into details about the loan and its repayment is yet another example of the former’s fishy behavior.

(Via NYT)