SHOWS

Covers Books

EVENTS

FEATURED

BRANDS

TRAVEL,

DRINKS & EATS

DRINKS & EATS

Latest

This Week’s Five Best Sneakers Drops, Featuring The Jordan 6 Infrared Salesman & More

Welcome to SNX, your weekly roundup of the best sneakers to hit the internet. It’s February 13th, and we’re barely dropping the first SNX of the year, so… what gives? Well, considering January is traditionally a quiet time for new sneaker releases — and this year was no different — we decided to sit it out and wait until the true 2026 sneaker year started, which just so happens to be this week in mid-February. As a new year in sneakers begins, we’ve decided to restructure SNX a bit — gone are the days when we highlight every single notable…

UPROXX Kicked Off NBA All-Star Weekend Right With A Celebration Of Music, Ball, And LA

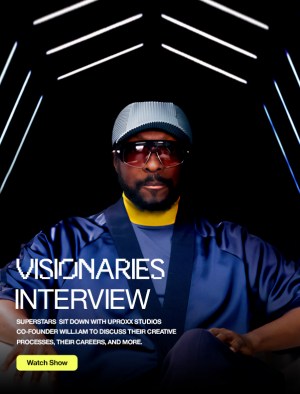

The 2026 NBA All-Star Game festivities culminate on Sunday, but All-Star Weekend is about so much more than the game. Officially, the action actually kicks off tonight (February 13), most notably with the All-Star Celebrity Game and the Rising Stars games. Tomorrow, there's also the iconic 3-Point Contest, Kia Shooting Stars, and Slam Dunk Contest. There are also plenty of key events during and surrounding the big weekend. Case in point: Last night, UPROXX, Dime, and Shoe Palace teamed up for the We LA All-Star Tip-Off Party. The at-capacity event, led by UPROXX Chief Visionary Officer will.i.am., was a big…

Weezer Compiled Their Classic Color-Themed Albums Into ‘Coloring Book,’ A Clever Vinyl Box Set

If you look at Weezer's discography, there's something about it that stands out from most other bands: They have six self-titled albums. Officially, they all have the same name, Weezer, but they're also known as the Blue Album, Green Album, Red Album, White Album, Black Album, and Teal Album, based on the primary color of the art's background. Now, Weezer have spun this into a fun idea for a vinyl box set: The group just announced Coloring Book, which features the aforementioned albums pressed on appropriately colored vinyl. The set itself is also a "comprehensive book experience" with 72 illustrations…

Charli XCX And Superfan Djo Collaborate On Charli’s New ‘Wuthering Heights’ Album That’s Out Now

Djo (aka Joe Keery) is a huge Charli XCX fan. In an interview from 2022, well before the launch of the now-iconic Brat era, he said Charli was one of his idols. He told Pitchfork around the same time, "Charli's just sick. She's a great pop star." In 2024, he also said, "I just think she's really cool and doing her own thing and not afraid to be yourself, which is kind of the... that's the whole point." It was surely a thrill for him, then, when he got to present alongside her at the Golden Globes back in January.…

Johnny Blue Skies Enters His Dance Era On A Newly Announced Album, ‘Mutiny After Midnight’

2024 saw the release of Passage du Desir, the debut album attributed to Johnny Blue Skies, an alter-ego of Sturgill Simpson. Now, he's going all in on the moniker: A new press release doesn't even mention Simpson's real name. As for the purpose of that release, today (February 13), the band Johnny Blue Skies & The Dark Clouds has announced Mutiny After Midnight, a new album. The project sees Simpson/Johnny Blue Skies return to Atlantic for his first time since 2016's A Sailor's Guide To Earth. In a statement, Johnny Blue Skies says of the label relationship and of the…

Dua Lipa Lends Her Vocals To Danny L Harle’s Thumping ‘Two Hearts’

Danny L Harle has mostly been in producer mode in recent years, but today (February 13), he has a new album of his own, Cereulean, out now. He called upon some of his big-shot friends to make it happen, including Dua Lipa, who sings on "Two Hearts." The track isn't too far out of Lipa's dance wheelhouse, but it's more clubby and electronic than she tends to lean in her own work. In a 2024 interview, Harle spoke about working with Dua on her album Radical Optimism, saying: "It’s indescribable to hear her sing in the room. I had the…

Cardi B Gave A Bunch Of Songs Their Live Debut To Launch The ‘Little Miss Drama Tour’

For as big as Cardi B is, she actually hasn't done a ton of touring. There was a run of arena shows in 2019 but that's it. That changed last night (February 11), though, when she kicked off the Little Miss Drama Tour in Thousand Palms, California. The setlist (via setlist.fm) overwhelmingly pulled from Cardi's new album Am I The Drama?, with 21 of the 37 songs performed coming from the project. A bunch of the album tracks, naturally, were performed live for the first time here. Other big hits from throughout her career, both her own songs like "WAP"…

Tame Impala Is Going On Tour And Taking Djo And Dominic Fike With Him

Back in September, Joe Keery, known musically as Djo, starred in Tame Impala's video for "Loser." Keery and Kevin Parker seem to have hit it off, as today (February 12), Tame Impala announced a run of North American tour dates, some of which will feature Djo as the opener. For the other ones, Dominic Fike is opening. The shows run from July to September. There will be various pre-sales starting February 18 at noon local time, while the public on-sale starts February 20 at noon local time. More information can be found on the Tame Impala website. Check out the…

‘Erupcja’: Everything To Know About Yet Another New Movie Starring Charli XCX

As Charli XCX was in the midst of her culture-defining Brat summer in 2024, she was also working on a secret movie. It didn't really stay secret for long, though, as word about Erupcja (the title being the Polish word for "eruption") quickly got out during filming. Erupcja is just the latest entry in Charli's quickly expanding filmography. In just 2025 and 2026, she appears in 100 Nights Of Hero, I Want Your Sex, The Gallerist, Faces Of Death, and of course, The Moment. Ahead of the movie's debut, keep reading for everything you need to know. Plot An official…

SA-RA Creative Partners Continue A Packed 2026 With The Throwback Soul Of ‘It’s Better With You (Forever With You)’

You've heard Sa-Ra Creative Partners -- the trio of Taz Arnold, Shafiq Husayn and Om'Mas Keith -- before. They and/or the group's members individually have collaborated with everybody from Jurassic 5 to Dr. Dre to Jay-Z. Keith also has a Grammy win in the Best Urban Contemporary Album category, for his work on Frank Ocean's iconic Channel Orange. That said, in terms of their own albums, it's been a while since that's been a focus. So far, they have two LPs to their name: 2007's The Hollywood Recordings and 2009's Nuclear Evolution: The Age Of Love. That's about to change,…

Jack Harlow Is Launching A New Era Soon As He Announces ‘Monica,’ An Album

The latest album news from Jack Harlow wasn't even his own: Back in June, Lorde said that Harlow had heard her album Virgin and told her of her lyrics, "These are bars!" She did note, though, that they met at New York's iconic Electric Lady Studios, where Harlow was working on new music. Soon, we'll get to hear it, as today (February 10), Harlow announced that a new album called Monica is coming on March 13. A press release notes the project was written over the past year at Electric Lady, and that the project was created followed Harlow's move…

Muna Finally Announce A New Album And Share ‘Possibly Our Favorite Song We’ve Made’

We're coming up on four years since Muna released their latest project, the self-titled album from the summer of 2022. At long last, though, they're coming back, as today (February 10), they announced Dancing On The Wall, a new album. They've also shared the title track, alongside a video. The song is extremely punchy and catchy synth-pop. In a statement, Muna says of the single: "Dancing On The Wall is possibly our favorite song we’ve made as a band. We think it’s all the best parts of MUNA -- it’s coming from a really emotional and lonely place, but the…

Stop At The Red Light For LA’s Best New Japanese Culinary Experience.

Hollywood has always been a culinary hotbed, but some of the best bites in town are tucked away and seldom spoken of. It's truly an IYKYK scene. Thankfully, we've found another of the city's best and brightest gems hiding in plain sight. Nestled directly next to Sunset Sound, where legends have etched their energies into Los Angeles' musical history for more than half a century, another kind of artistry is unfolding in the form of two restaurants housed in one building, each devoted to a different expression of craft. This is Udatsu and Rokusho, a dual establishment that shares an…

King Of Kentucky Debuts Three New Bourbons — Here’s Our Review

The King (of Kentucky) is back! Hot on the heels of landing at the number two spot on the UPROXX "Best Bourbons of 2025" list, King of Kentucky is maintaining the momentum by debuting a brand-new small-batch version of its critically acclaimed single-barrel bourbon. New for 2026, King of Kentucky Small-Batch Bourbon is a single blend of Brown-Forman bourbon, bottled at three different proof points to deliver notably different results. Batch 1 is bottled at 105 proof, Batch 2 at 107.5 proof, and Batch 3 at 110 proof. Each batch features a blend of barrels aged 12-18 years, delivering a…

Geese Continue Their Superlative Run With A Fantastic NPR Tiny Desk Concert

Back in December 2025, Geese stopped by the NPR offices to film an installment of the beloved Tiny Desk Concert series. Now, today (February 10), the performance has finally been shared. As they tend to do, Geese messed with the arrangements a little is they played their three-song set of "Husbands," "Cobra," and "Half Real." Cameron Winter also had some fun with the gathered audience between songs, joking, "Is this a ticketed thing or is this...? How do you guys get into this? I thought it was just NPR staffers here, I don't know... and friends. NPR staffers don't have…

‘The Rise Of The Red Hot Chili Peppers’: Everything To Know About Netflix’s New RHCP Documentary

The current Red Hot Chili Peppers lineup of Anthony Kiedis, Flea, Chad Smith, and John Frusciante is the longest-running iteration and the one fans know best. Over the years, though, the group has had a ton of personnel changes. One of the most notable members from the group's early era is Hillel Slovak, who joined the band shortly after it was founded. Save for a brief hiatus, Slovak was with the band from 1982 to 1988. In '88, he tragically died of a heroin overdose. Now, Slovak's story and impact is being honored in a new Netflix documentary, The Rise…

Bruno Mars Just Set A Huge World Record For The Largest-Ever Concert In A Video Game

When Bruno Mars started his music career, odds are he never imagined that one day, he'd host an online concert in a video game, let alone in a game on Roblox called Steal A Brainrot. But, on January 17, that's exactly what he did (here's a recording of the performance). It went very well: Not long after the show, it was reported that at its peak, the performance was watched live by 12,862,161 concurrent users, which was said to be a new record for the most-watched virtual concert of all time. Now, the folks at Guinness World Records have stepped…

The Wedding From Bad Bunny’s Super Bowl Halftime Show Was Real, It Turns Out

Bad Bunny's Super Bowl Halftime Show from last night (February 8) has been getting rave reviews since the Puerto Rican superstar left the stage/field. One part in particular that stood out was the portion of the performance when the focus was on an unnamed couple, who had a brief wedding ceremony before locking lips. Well, it turns out that wasn't just for show: It was an actual, real, legally binding wedding, a representative for Bad Bunny confirmed to the Associated Press. The publication further notes that the couple initially invited Bad Bunny to their wedding, but he decided to one-up…

Jennie Adds A New Spin To Tame Impala’s Hit ‘Dracula’ On A Fresh Remix

What is Tame Impala's biggest song? If you're looking at Spotify, "The Less I Know The Better" has over 2.2 billion streams. If you're looking at the Billboard Hot 100, the 2025 single "Dracula" was, somehow, the first Tame Impala song to hit the chart. (The song came out a month before Halloween, which probably helped.) Now, it would seem the single is about to get an even bigger bump, as today (February 6), Jennie of Blackpink fame has hopped on a new version of the track. The song isn't much of a remix in the sense that the instrumental…

Maisie Peters Links With Amelia Dimoldenberg And Benito Skinner For Her New ‘My Regards’ Video

Maisie Peters is on a roll. In 2023, she released her second album, The Good Witch, which was her first to go No. 1 in her native UK. In 2024, she was an opener on some of the year's biggest tours: Taylor Swift, Coldplay, Noah Kahan, and Conan Gray. She's set to once again make 2026 her year, as she recently announced Florescence, a new album set for May 15. Today (February 6), she shares a new single, "My Regards," and a video. Amelia Dimoldenberg, of Chicken Shop Date fame, directs, while Benito Skinner stars alongside Peters. In a statement,…

Robyn Is Going On Tour With A Bunch Of Great Openers, Including Lykke Li And Romy

Robyn has an anticipated new album, Sexistential, ready to drop towards the end of March. After giving fans a few months to digest the project, Robyn is going on The Sexistential Tour, which she just announced today (February 6). The run spans from June to November, with the North American stretch hitting Washington DC, Brooklyn, Chicago, Toronto, Mexico City, and Los Angeles in September. She has a huge and great set of openers that features Erika de Casier, Smerz, 808 State, Saya Gray, Mechatok, Romy, Zhala, Becky and the Birds, Nourished By Time, Peaches, Grace Ives, Lykke Li, and horsegiirL.…

Sombr Returns With ‘Homewrecker’ And A Western Video Co-Starring Quenlin Blackwell And Milo Manheim

Sombr had a massive 2025 with the release of his debut album, I Barely Know Her, which made the top 10 of the Billboard 200 chart. At the very end of 2024, lead single "Back To Friends" was a breakout hit, becoming his first single to hit the Hot 100 chart, doing so with a peak at No. 7. It was also one of the top songs of 2025 on Spotify. His 2026 is getting off to a great start, too. He was a show-stopper with his performance at the Grammys last weekend. Today (February 6), he returns with "Homewrecker,"…

‘Boyfriend On Demand’: Everything To Know About Jisoo’s New Netflix Rom-Com Series

Jisoo is best known as one of the members of Blackpink, of course, but she's been getting more into acting over the past few years, too. She had leading roles in the TV series Snowdrop and Newtopia, as well as the movie Omniscient Reader: The Prophecy. Now she's getting back in front of the camera again, in another new show, Boyfriend On Demand. The series was initially developed for the leading South Korean TV station MBC, but Netflix, likely motivated by Jisoo's star power, picked up the show. So, while some of Jisoo's other acting work has been tough to…

Uproxx’s Joypocalypse Discusses How Circle Jerks Made Punk Harder And Faster

The initial dissolution of Black Flag was tough for fans to swallow. What made it go down easier, though, was that the group's Keith Morris had another great band going, too: Circle Jerks. Forming in 1979, the band helped spearhead a new aggressive era for punk music. Their impact was immense and their work lived on in subsequent generations, as everybody from Red Hot Chili Peppers to Pearl Jam to the Offspring have cited them as an influence. As Uproxx's Joypocalypse notes, the band was "part of the first wave that turned punk into something harder, faster, and more agro."…

Miss Piggy Insists There’s No Beef With ‘Muppet Show’ Co-Star Sabrina Carpenter After Getting ‘Arrested’ At Her Concert

At the end of her Short N' Sweet Tour in November 2025, Sabrina Carpenter capped off her tradition of making fake arrests by putting one more celebrity in custody: Muppets icon Miss Piggy. Now, the puppet herself is addressing if there's any lingering beef with her The Muppet Show co-star. In a chat with TV Insider (here's the video), the interviewer asked if Carpenter being on the show meant she and Miss Piggy had made up following the arrest. Miss Piggy noted the show was actually filmed before that concert moment but went on to say, "I mean, you know,…

We Tried Papa Johns New Pan Pizza Ahead Of Super Bowl Weekend

Super Bowl LX touches down in just four days, so it’s time to figure out your game plan. No, we’re not talking about where you’re watching or who you’re watching with. We’re talking about the most important thing about any Super Bowl party — what does the food spread look like? You have to make sure you have the best person in your circle on salsa, guacamole, and drinks duty, but above all else, you need the best pizza your money can buy. Which means it's time to reignite the age-old debate over which of the big pizza brands is…